Market Got You Down? The Silver Lining: Stocks Still Reign Over Cash

Deprecated: Function create_function() is deprecated in /home3/micprice/public_html/wp-content/plugins/seo-ultimate/includes/jlfunctions/arr.php on line 76

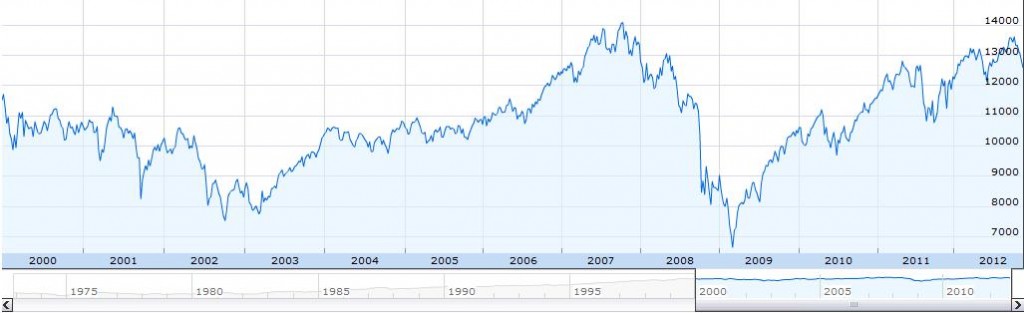

Most economists agree that 2000 marked the beginning of a secular bear market.

Secular markets describe 10-20 year spans of new market highs (secular bull markets) or market declines of at least 40% (secular bear markets). Secular bear markets also describe periods where the market is unable to surpass new highs.

Secular markets begin during distinct moments of economic and cultural events. For example, the 1982 start of the 18-year secular bull market kicked off amid the end of the early 80’s recession and start of Baby Boomer-driven economic expansion.

The 2000 secular bull market began during the Bush/Gore election results debacle, and confirmed itself during the 2001-2002 Iraq war:

While we may have both short (e.g., “cyclical”) bull and bear markets during secular markets, the overarching market (e.g., “secular” market) may still be considered by economists as a bear or bull market.

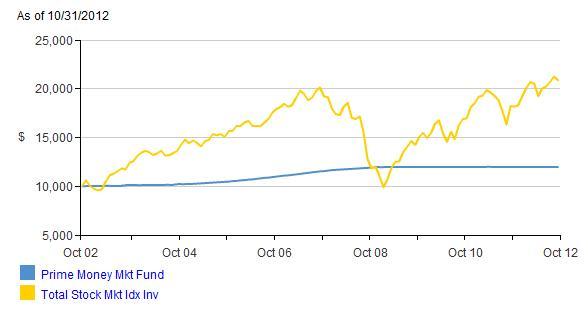

What if you invested in a portfolio of stocks that mirror the S&P 500 at the beginning of our current 12-year-long secular bear market, and now wonder if you should have stayed in cash?

The chart below compares a $10,000 investment in the Vanguard Total Stock Market Index fund (VTSMX) versus a $10,000 investment in Vanguard’s Prime Money Market Fund (VMMXX):

The Vanguard Total Stock Market Index fund is a domestic stock fund that invests broadly across sectors and capitalizations. The Vanguard Prime Money Market Fund seeks to provide current income and preserve shareholders’ principal investment. The chart above is unadjusted for fund fees. Past performance does not imply future performance.

While investing in stocks may not be suitable for all savers — 2008 being a great example — the above shows that over the long term, stocks still outpace cash even if it doesn’t feel like it does.

Watch economic trends in the market. Especially as you get closer to needing the money that you have invested. And speak to a professional if you’re unsure how to invest for your goals.

Comment (1)

Comments are closed.