QE 3 and Money Moves in a Low Interest Rate Environment

Deprecated: Function create_function() is deprecated in /home3/micprice/public_html/wp-content/plugins/seo-ultimate/includes/jlfunctions/arr.php on line 76

The Federal Reserve put a third round of quantitative easing in place on September 13th. The Fed pledged to buy $40B of mortgage-backed securities each month until the unemployment rate falls below 7%. Analysts believe the rate may not fall to this level until 2014.

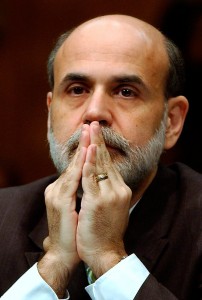

The Fed also pledged to keep interest rates low until at least 2014 as well. In fact, near-zero. While Fed Chairman Bernanke hopes these actions will spur employment and the stock market, what if you’re retired and invested in bonds and other forms of fixed income?

If you purchased bonds before November 2008 when the first round of quantitative easing occurred, you may still be enjoying more than 3% interest from your bonds.

However, if you purchased bonds after 2008, your bonds may have had interest payments lower than the rate of inflation. Although you may get growth of your principal if you purchased your bond below its face value, your interest payments may not be enough for you to not lose purchasing power.

What’s an alternative to bonds in a low interest rate environment like today? The most common alternative are blue chip stocks, at least until interest rates are allowed to rise back up. Once again, that may not happen until after 2014.

Look for blue chips that have a dividend yield of 3% or higher. Also look for blue chips with a low “beta” – between 0 and .8. Beta describes how active the stock’s price is in comparison to the overall market. If you’re looking for an alternative to bonds, you want a blue chip that maintains a steady price.

Common blue chips include Proctor and Gamble and Johnson and Johnson. Talk to someone you know and trust for additional ideas, and in particular before changing your strategy.

Comments (2)

Comments are closed.